The post What are the market prices of China parking lift equipment? appeared first on FAQ.

]]>Mechanical parking lift equipment is one of the main ways to solve the problem of difficult urban parking. The number of mechanical parking systems in China is expected to decrease by 18% by 2023.

What is the popular parking lift equipment in China?

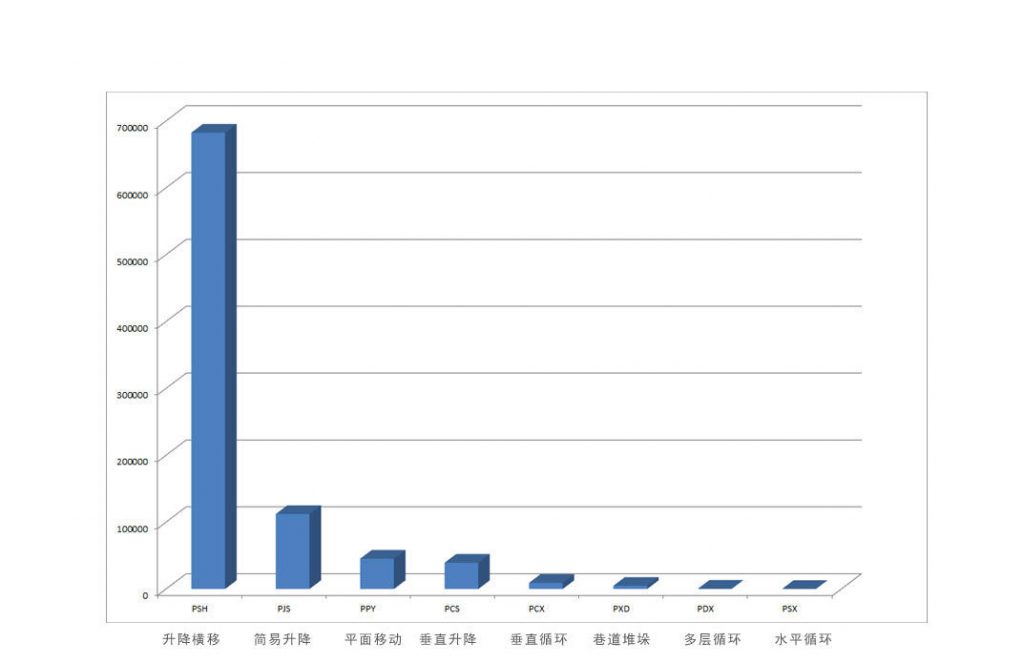

The parking system is a mainstream parking lift device type. The puzzle parking system category still maintains the first position in China. Its market share is 67%. The price is 16,000 RMB per unit.

Second place is in the category of the PPY model automated parking system. Its market share is 9.7%. The price of the PPY model is 49,000 RMB per unit.

Third place is the category of the vertical lifting tower parking system. The price of the vertical tower parking system is 92,000 RMB per unit. Its market share is 8.7%.

Fourth place is in the category of the vertical rotary carousel parking system. The market share is 7.2%. The price of a rotary parking system is 59000 RMB per unit (per parking space).

Fifth place is in the category of the stack parking system. Its market share is 6.4%. The price of a stack parking system is 15,000 RMB per unit.

The post What are the market prices of China parking lift equipment? appeared first on FAQ.

]]>The post China Market Report on Mechanical Parking Machines 1ST Q 2024 appeared first on FAQ.

]]>In the first quarter, the procurement of complete mechanical parking machines was mainly concentrated in four markets: office, hospital, residential, and municipal public.

The occupancy rate of mechanical parking equipment for office projects is 27.8%. The market share of the hospital mechanical parking equipment project is 24.7%. The occupancy rate of residential mechanical parking equipment projects is 23.5%. The market share of municipal public mechanical parking equipment projects is 16%.

The office project is built for government agencies, enterprises, institutions, commercial office buildings, and industrial parks. The proportion of developers in office building parking system projects is 48.9%. The proportion of the industrial park management committee is 22.2%. The market share of government agency projects is 13.3%. The proportion of public institutions is 8.9%, while state-owned enterprises such as banks and power companies account for 6.7%.

The bidding projects for mechanical parking machines in the first quarter, Guangdong, Zhejiang, and Jiangsu are the top three provinces for constructing mechanical parking garages. The top four parking projects in urban construction are Shanghai, Guangzhou, Beijing, and Nanjing.

Distribution of types of mechanical parking machines

Among all product types, the proportion of puzzle parking systems is 63.8%. The market share of car stacker parking products is 10.5%. The proportion of vertical rotary parking system classes is 8.6%. The market share of automated parking systems is 11%. The proportion of other device types is 5.7%. Since 2024, the proportion of vertical circulation projects has increased. Many projects require the construction of SUV parking spaces.

The post China Market Report on Mechanical Parking Machines 1ST Q 2024 appeared first on FAQ.

]]>The post What is the new trend of parking equipment in China? appeared first on FAQ.

]]>China’s parking equipment market achieved results but faced greater challenges in 2023. “This year, we conducted research on some companies and found it even more difficult than last year,” a parking industry insider in the mechanical parking system manufacturing industry said. Due to the contraction of the real estate market and various impacts this year, mechanical parking system manufacturing enterprises are facing even more difficulties. According to data from the Parking Industry Association, the industry’s total sales decreased by as much as 11% last year.

30 years of remarkable achievements in mechanical parking equipment

Since 2010, China’s mechanical parking system market has entered an era of explosive growth. After more than 30 years of development, the variety satisfaction rate of China’s mechanical parking equipment has reached about 90%. It has more than 90% of products have a localization rate and export capability.

Developing toward scenario-based parking lift customization

China is increasing research and development of mechanical parking systems to meet the needs of smart cities. Some manufacturers launch garage products and business models suitable for renovating and upgrading old residential areas.

The new trend

Firstly, there is insufficient demand in the market for mechanical parking equipment. Secondly, the people’s understanding and acceptance of its technology are limited. Once again, the cost pressure on mechanical parking equipment manufacturers has increased. Finally, policy promotion and regulatory efforts are insufficient.

Used equipment filled the market to deceive the government into conducting inspections. This is already a cancer that affects the healthy development of the parking market.

The post What is the new trend of parking equipment in China? appeared first on FAQ.

]]>